❖ How to Process Payroll Within Xero for JobKeeper Payments

IMPORTANT – Before you decide to process payments for JobKeeper, you must ensure you are eligible to enrol, and to determine which period in which you need to process Job Keeper for.

Xero has set up 2 new pay items.

- Job Keeper

- Job Keeper Payment top-up

Step 1: Apply the JobKeeper Wage Payment Pay Item to your Employee’s

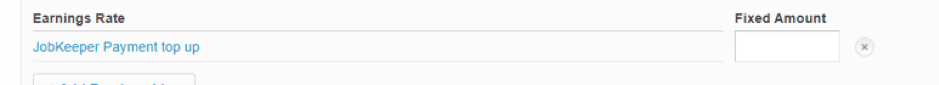

Go to Payroll/ Employees. Click on an Employee’s Name, click on the Pay Template tab, Add Earnings Line – select JobKeeper Payment Topup, or Job Keeper (if the employee is not going to work for the job Keeper. Most of the time you will enter in JobKeeper Payment Topup.

Apply this pay item to all relevant employees.

Apply this pay item to all relevant employees.

Step 2: Pay Employees

Click on Payroll, Pay Employees, Add Pay Run, select pay period, Next, click on an employee to view their pay details.

Edit the JobKeeper payment details as necessary.

Here are three examples, using a Weekly Pay Calendar. You will need to adjust accordingly for a Fortnightly or Monthly Pay Run.

If you pay your employees weekly you can keep the same pay calendar, you just need to make sure you pay a minimum of $1500 ie $750 per week. Which also equates to $150 per day.

There are a number of scenarios.

- The employee continues to work but earned more than $750 per week

- The employee did not work during the pay period

- The employee worked during the pay period but earned less than $750 per week.

Example 1: Employee continues to work but earned more than $750 per week

Process payroll via STP as per normal. No need to add any new pay earnings line.

Example 2: Employee did not work during this pay period

Enter in the full $750 into the JobKeeper payment field

You will notice that this payment has been taxed and that Superannuation has not been added.

You will notice that this payment has been taxed and that Superannuation has not been added.

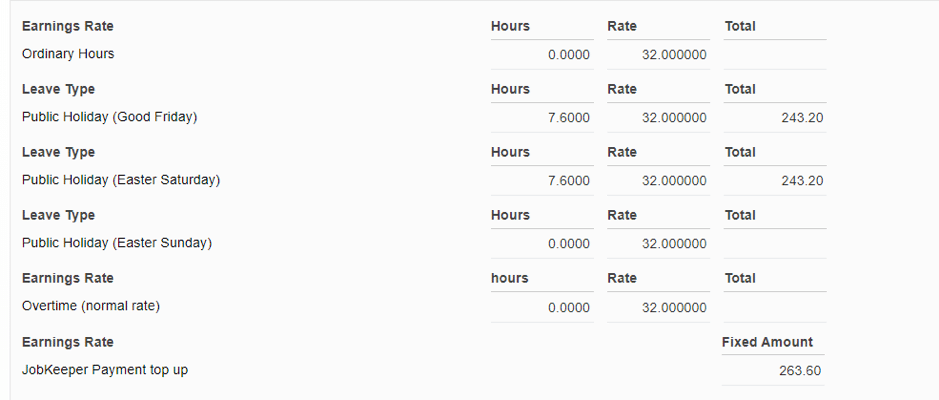

Example 3: Employee worked during the pay period, but earned less than $750

Enter the number of hours the employee worked at their regular rate/s.

If their gross earnings are less than $750, in the JobKeeper Payment top-up line, balance out the payment to $750. Eg if the other pay rates totalled $400 then put $350 into this pay type. As you must pay a minimum of $750 per pay week.

You will notice that this payment has been taxed and that Superannuation has only been added to the hours that the employee has actually worked.

You will notice that this payment has been taxed and that Superannuation has only been added to the hours that the employee has actually worked.